LKPM BKPM Indonesia Investment Activity Report is mandatory for foreign-owned limited liability companies (PT PMA) to submit reports detailing their investment activities according to the Law No. 25, 2007.

The Investment Activity Report (LKPM BKPM) is the standard report on the achievements and constraints faced by investors in a determined company. The LKPM serves as a tool for the Indonesian Investment Coordinating Board (BKPM) to analyse and find solutions to the challenges faced by investors in Indonesia.

The LKPM BKMP encompasses all business sectors (except trading) and aims at monitoring the progress and outcome of investments and productions. For companies investing in the trading sector, the LKPM only covers the location stated in the business principle license.

In order to increase the monitoring of capital investment realisation, BKPM issued a Regulation of the Head of BKPM No. 13 of 2009 dated 23rd December 2009 as amended by a Regulation of Head of BKPM No. 7 of 2010 dated 31st March 2010 concerning Guidelines and Procedures for the Control of Capital Investment Implementation (“BKPM Regulation on LKPM”).

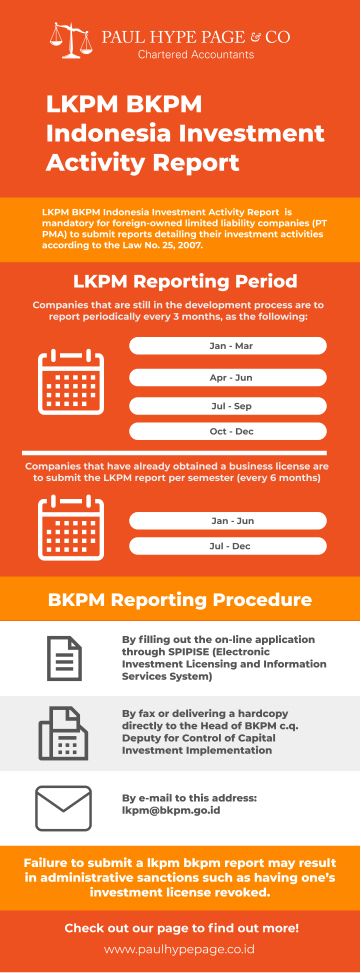

LKPM Reporting Period

The LKPM reporting deadline varies based on the company’s legal entity and development process stage. Companies that are still in the development process are to report periodically every 3 months, as the following:

- January – March period, LKPM must be submitted by April 10thof the same year.

- April – June period, LKPM must be submitted by July 10th of the same year.

- July – September period, LKPM must be submitted by October 10th of the same year.

- October – December period, LKPM must be submitted by January 10th of the following year.

Companies that have already obtained a business license are to submit the LKPM report per semester (every 6 months), as below:

- LKPM Report for Semester I (January – June) must be submitted by July 10th of the same year.

- LKPM Report for Semester II (July to December) must be submitted by January 10th of the following year.

Foreign companies are to submit their LKPM report only once, by the end of the same year. Foreign investors must also be aware that – for every company with a capital investment activity that covering more than one municipality/city – the LKPM must be submitted to each single municipality/city. In the same manner, companies investing in multiple business sectors must declare each business field in a separate report. Companies located in a free trade zone and free port zone as well as other specific economic zones, must submit their LKPM to each head of the zones concerned. In case of a completed company merger, the final company has to submit the LKPM for all capital investment activities as the result of the merger.

BKPM Reporting Procedure

Companies must submit the LKPM in accordance with the forms provided in the BKPM Regulation on LKPM. This can be done in several ways:

- By filling out the on-line application through SPIPISE (Electronic Investment Licensing and Information Services System)

- By fax or delivering a hardcopy directly to the Head of BKPM c.q. Deputy for Control of Capital Investment Implementation

- By e-mail to this address: lkpm@bkpm.go.id

It is a company’s duty to appoint a responsible individual whose role is to coordinate the outline of the LKPM. The name of the individual in charge must be provided to BKPM using a form found in the BKPM Regulation on LKPM.

Failure to submit a lkpm bkpm report may result in administrative sanctions such as having one’s investment license revoked. Submission of LKPM is regulated by the Regulation Head of Investment Coordinating Board No. 3 year 2012, on revision to Regulation Head of Investment Coordinating Board No. 13 year 2009 which covers the guidelines and procedures for the control and implementation of investments.